Polaris

📢 Note: In case of a discrepancy between the Income Certificate and ITR, the higher value of income will be considered.

Required Documents For Fee Waiver Based on Category

Salaried Class (Govt. or Private Employees)

- Self-attested copy of annual family income certificate issued by local district authorities

- Self-attested copy of Form-16 issued by employer (if applicable)

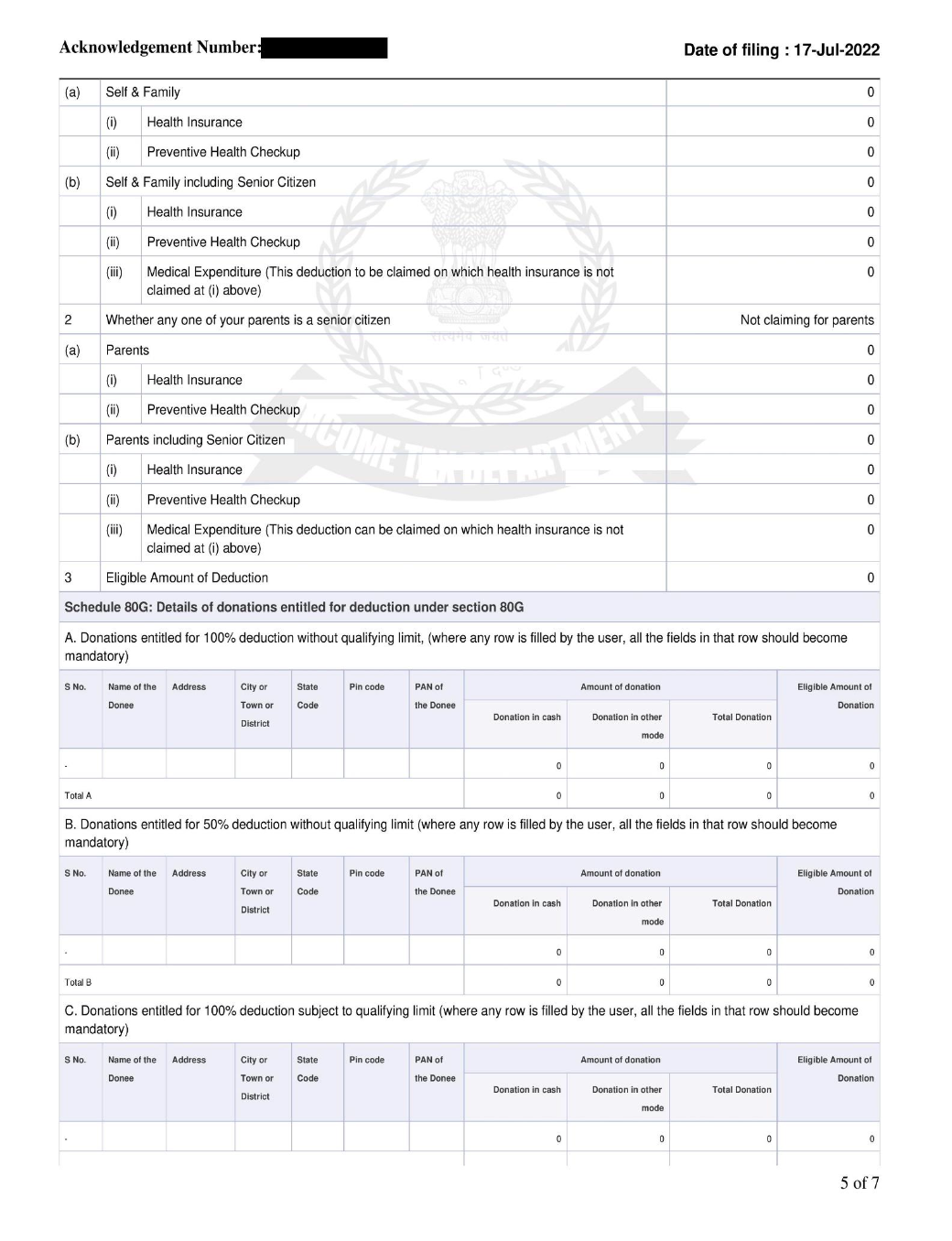

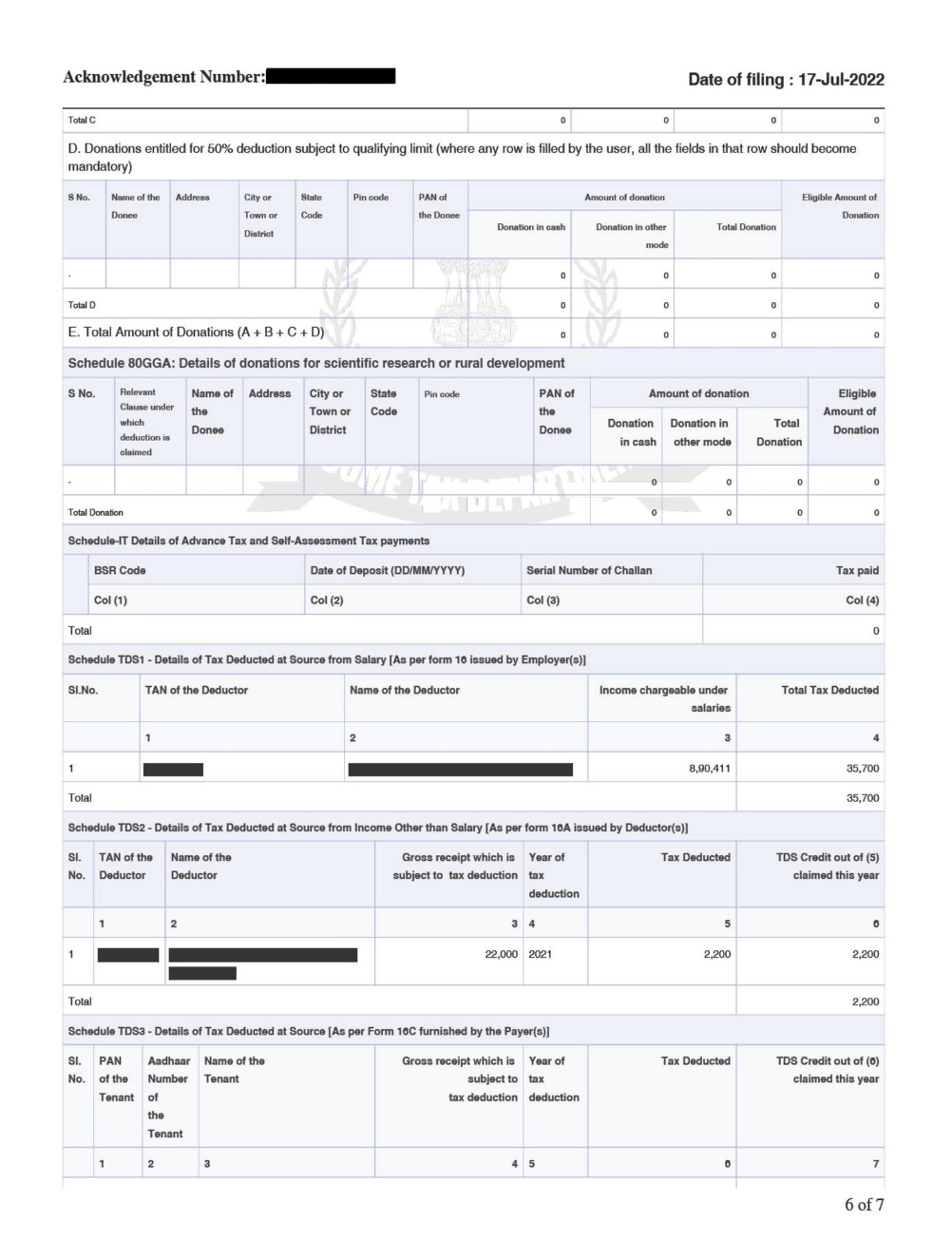

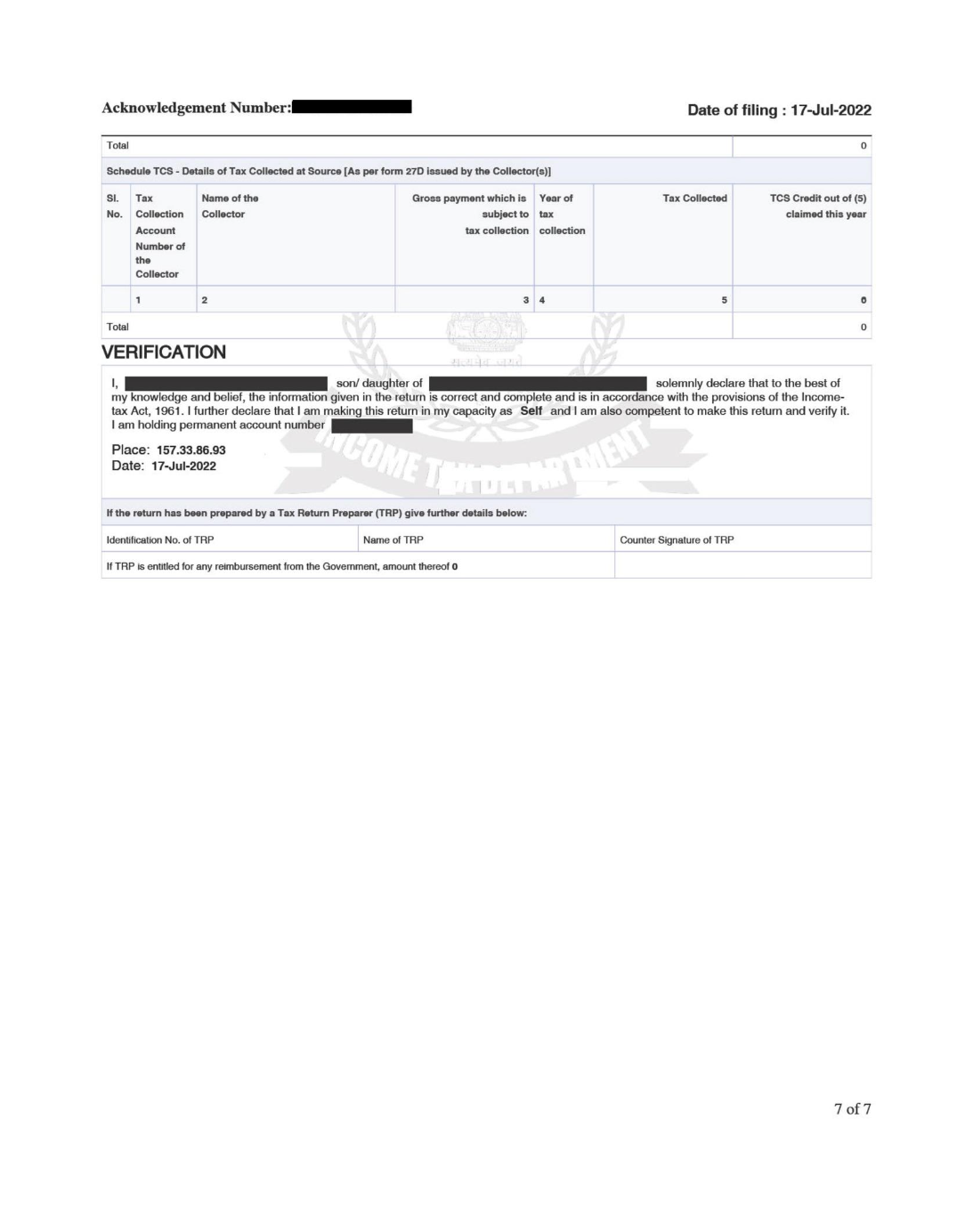

- Self-attested complete Income Tax Return (ITR) form, including total income computation (salary, house property, other sources), duly acknowledged by income office

Non-Salaried Class (Business, Agriculture, Legal, Medical, Tutors, Contractors, etc.)

- Self-attested copy of annual family income certificate issued by local district authorities

- Self-attested complete Income Tax Return (ITR) form, including income from business, house property, or other sources, duly acknowledged by income office

Pensioners / Family Pensioners

- Self-attested copy of annual family income certificate issued by local district authorities

- Self-attested complete Income Tax Return (ITR) form, including income from pension, house property, or other sources, duly acknowledged by income office

Enclosures

- Annexure I: State/UT-wise list of income certificate issuing authorities

- Annexure II:

- A. Sample copy of complete ITR form (includes total income computation)

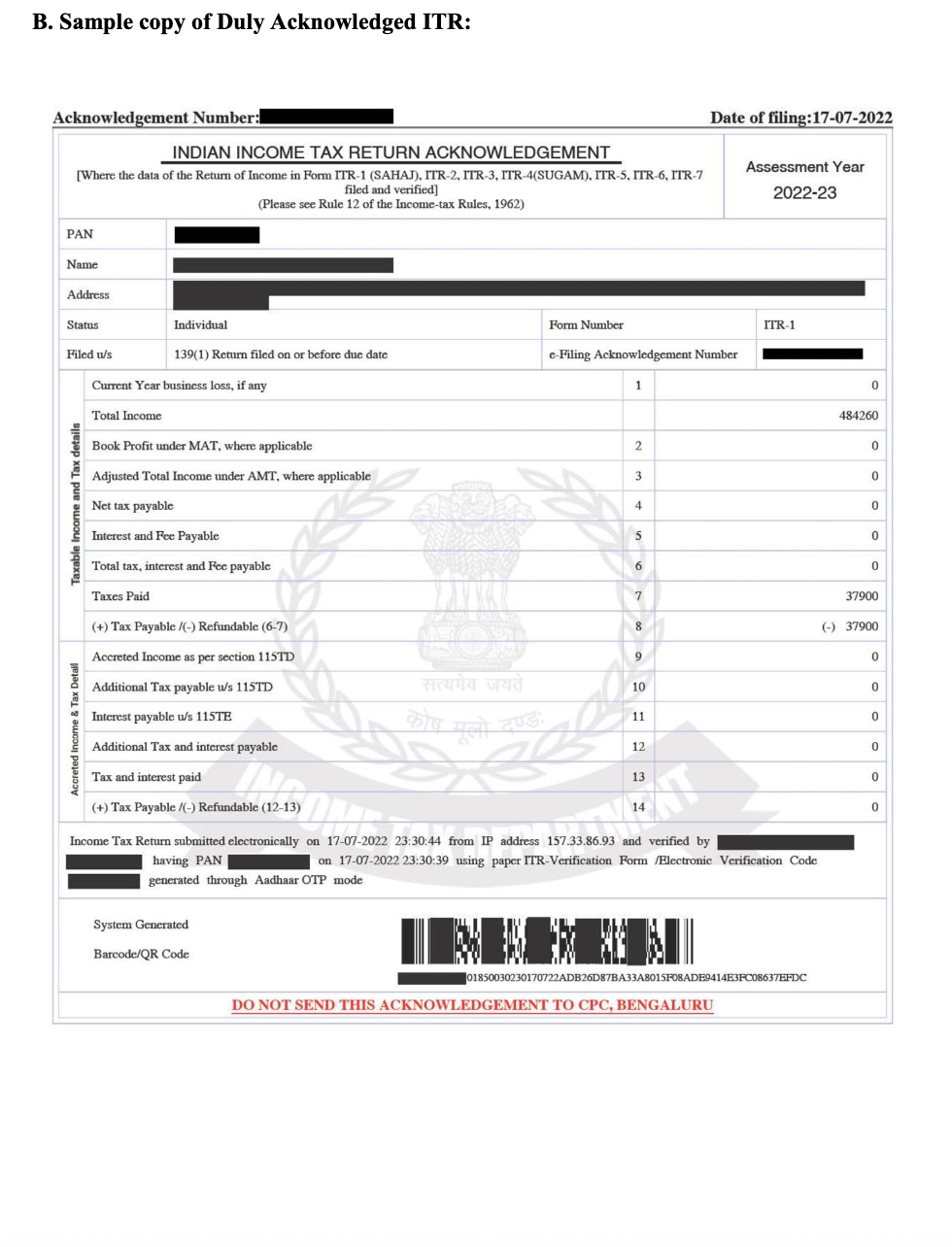

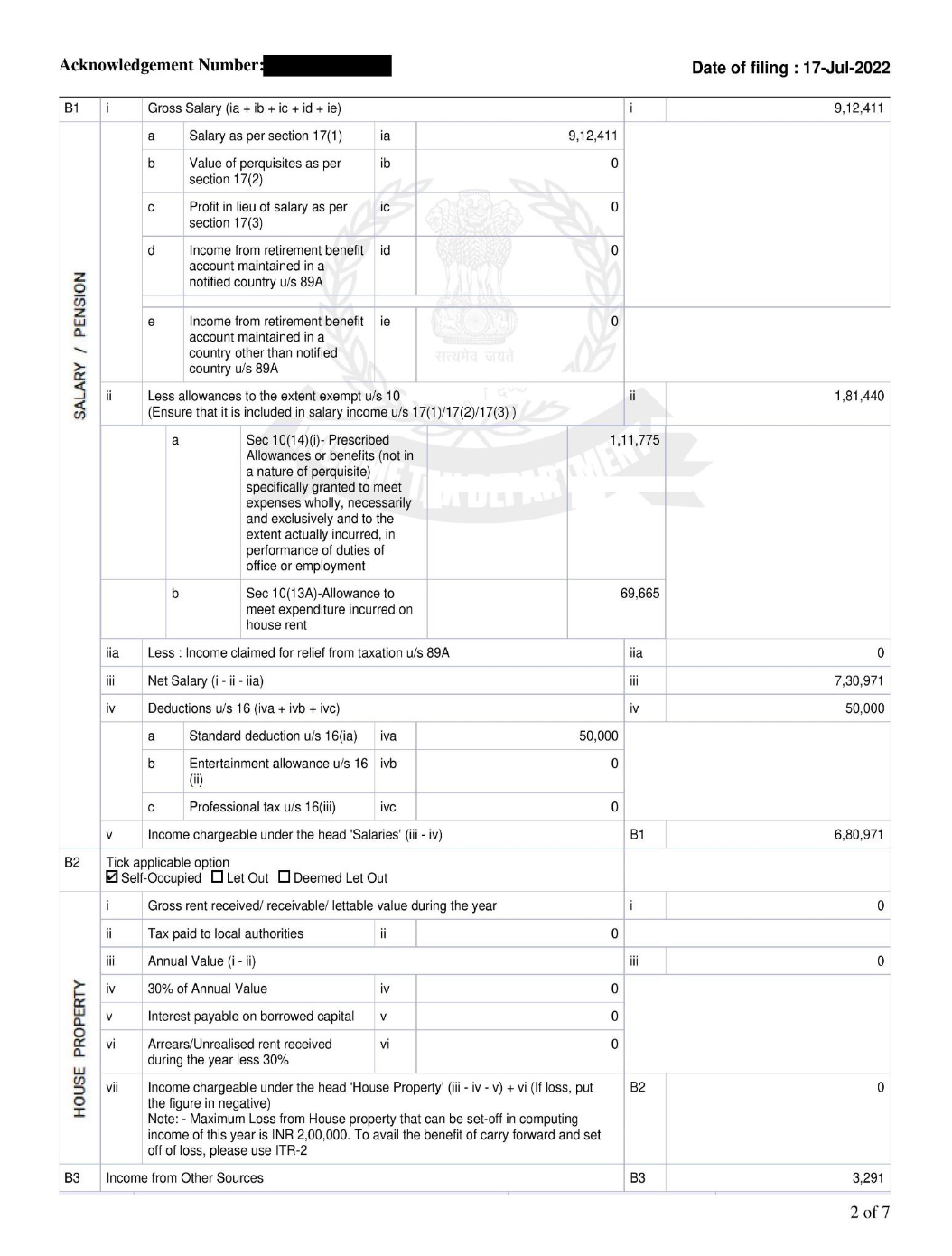

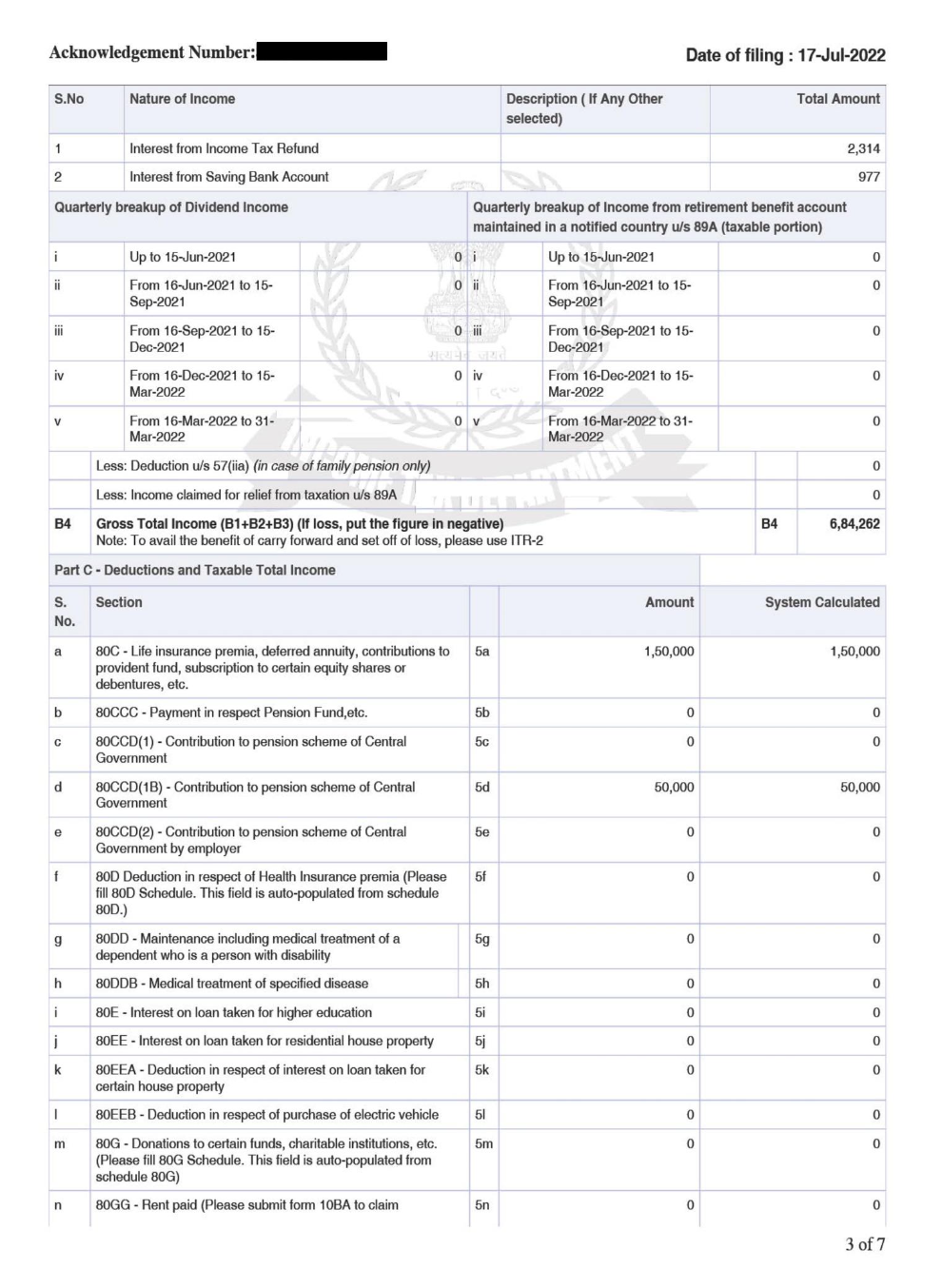

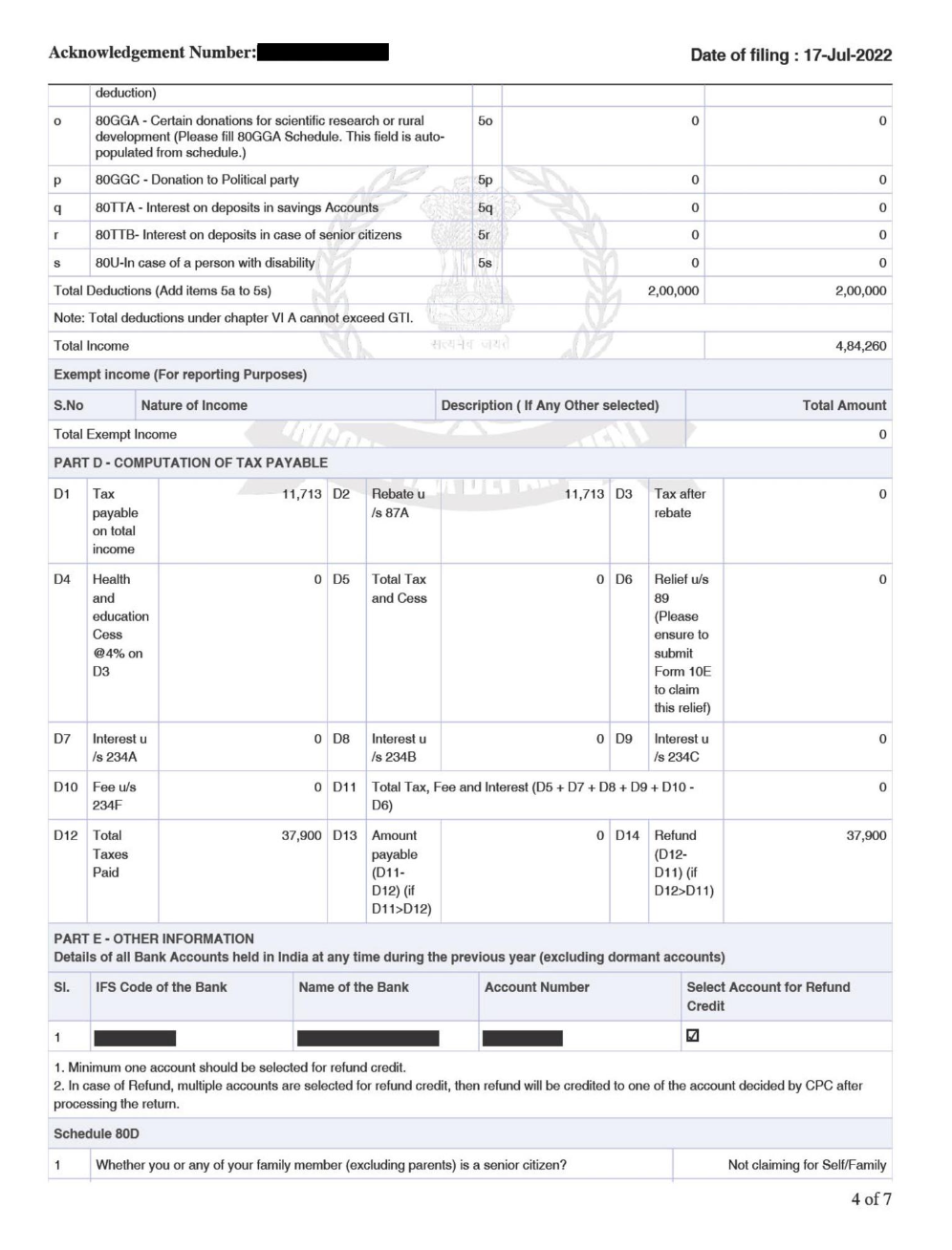

- B. Sample copy of duly acknowledged ITR

Annexure I – Income Certificate Issuing Authorities (State/UT Wise)

| State / UT | Issuing Authority |

|---|---|

| Andaman and Nicobar Islands | Tehsildar / SDM / Deputy Commissioner |

| Andhra Pradesh | Tahsildar |

| Arunachal Pradesh | Deputy Commissioner |

| Assam | Circle Officer |

| Bihar | Circle Officer / Block Development Officer (BDO) |

| Chandigarh | Sub-Divisional Magistrate (SDM) |

| Chhattisgarh | Tehsildar / Naib Tehsildar |

| Dadra and Nagar Haveli and Daman and Diu | Mamlatdar / Tehsildar |

| Delhi (NCT) | Sub-Divisional Magistrate (SDM) / Revenue Officer |

| Goa | Mamlatdar |

| Gujarat | Tahsildar |

| Haryana | Tehsildar / Sub-Divisional Magistrate (SDM) |

| Himachal Pradesh | Tehsildar / SDM |

| Jammu and Kashmir | Tehsildar / SDM / Deputy Commissioner |

| Jharkhand | Circle Officer / Block Development Officer (BDO) |

| Karnataka | Tahsildar |

| Kerala | Village Officer / Tahsildar |

| Ladakh | Tehsildar / SDM / Deputy Commissioner |

| Lakshadweep | Tehsildar / SDM |

| Madhya Pradesh | Tehsildar / SDM / Sub-Divisional Officer (Revenue) |

| Maharashtra | Tahsildar |

| Manipur | SDM / DC Office |

| Meghalaya | Deputy Commissioner |

| Mizoram | Deputy Commissioner |

| Nagaland | Additional Deputy Commissioner |

| Odisha | Tehsildar |

| Puducherry | Deputy Tahsildar / Revenue Officer |

| Punjab | Tehsildar / SDM |

| Rajasthan | Tehsildar / SDM |

| Sikkim | District Collector |

| Tamil Nadu | Tahsildar |

| Telangana | Tahsildar / Mandal Revenue Officer (MRO) |

| Tripura | Tehsildar / SDM |

| Uttar Pradesh | Tehsildar |

| Uttarakhand | Tehsildar |

| West Bengal | Block Development Officer (BDO) |

| All UTs (general fallback) | Sub-Divisional Magistrate (SDM) / Collector / Deputy Commissioner |

Annexure II – Sample ITR Forms

A. Sample Complete ITR Form (Computation of Income)

B. Sample Copy of Duly acknowledged ITR